Some Known Facts About Pvm Accounting.

Some Known Facts About Pvm Accounting.

Blog Article

Some Of Pvm Accounting

Table of ContentsThe Facts About Pvm Accounting UncoveredFascination About Pvm AccountingThe Main Principles Of Pvm Accounting 7 Simple Techniques For Pvm AccountingUnknown Facts About Pvm AccountingThe Best Guide To Pvm AccountingGetting My Pvm Accounting To Work

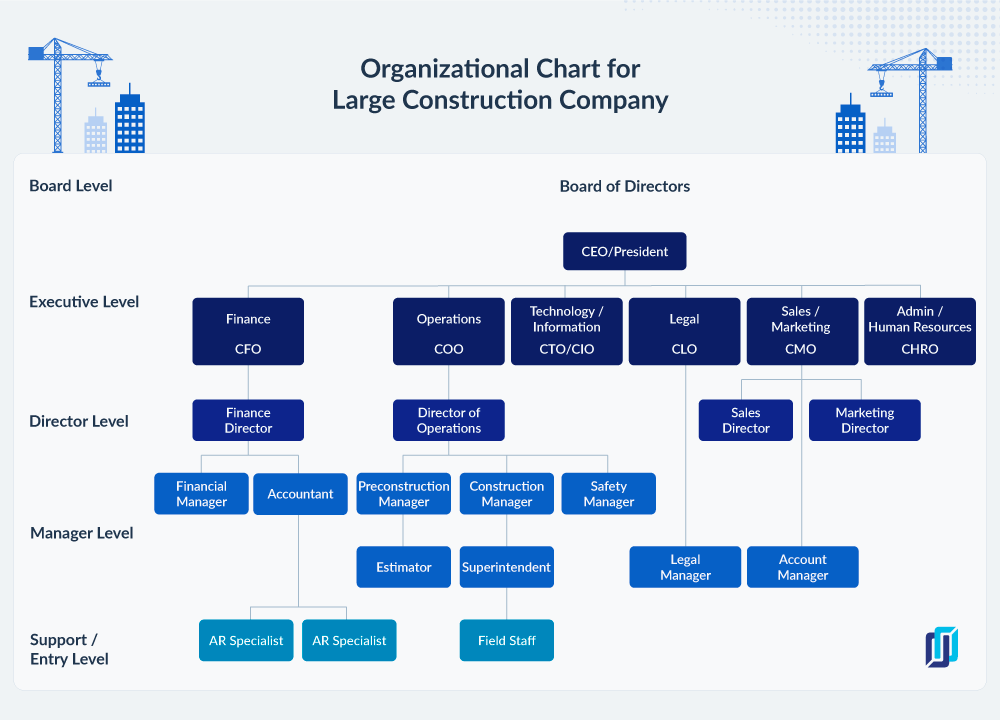

In regards to a business's general technique, the CFO is in charge of guiding the business to satisfy economic goals. Some of these strategies might involve the business being obtained or acquisitions going ahead. $133,448 per year or $64.16 per hour. $20m+ in yearly income Professionals have developing needs for workplace supervisors, controllers, accountants and CFOs.

As a company grows, accountants can free up extra staff for other service tasks. As a building and construction firm grows, it will certainly require the help of a full time financial personnel that's handled by a controller or a CFO to handle the company's funds.

What Does Pvm Accounting Do?

While big businesses could have full time financial backing groups, small-to-mid-sized companies can work with part-time bookkeepers, accounting professionals, or financial experts as needed. Was this short article valuable? 2 out of 2 individuals discovered this valuable You voted. Adjustment your response. Yes No.

As the building and construction industry continues to flourish, organizations in this sector should keep solid economic monitoring. Reliable accounting practices can make a considerable distinction in the success and development of construction companies. Let's discover 5 essential accountancy techniques tailored particularly for the building and construction sector. By implementing these practices, construction companies can improve their monetary security, streamline operations, and make informed choices - Clean-up accounting.

Detailed estimates and budget plans are the foundation of building and construction job administration. They assist steer the task in the direction of prompt and profitable conclusion while safeguarding the rate of interests of all stakeholders included. The crucial inputs for job expense evaluation and budget are labor, materials, equipment, and overhead expenditures. This is normally one of the biggest expenditures in building and construction tasks.

The Facts About Pvm Accounting Uncovered

An exact evaluation of materials required for a task will certainly help make certain the required materials are purchased in a timely fashion and in the best quantity. A bad move here can cause wastefulness or delays because of product shortage. For many construction jobs, tools is required, whether it is purchased or rented.

Correct tools estimate will help see to it the right equipment is available at the right time, conserving money and time. Don't forget to represent overhead expenditures when approximating project costs. Direct overhead expenses are certain to a task and may include short-lived rentals, utilities, fencing, and water materials. Indirect overhead expenditures are everyday costs of running your business, such as rent, administrative incomes, utilities, taxes, depreciation, and marketing.

Another element that plays into whether a task succeeds is a precise quote of when the project will be finished and the relevant you could try these out timeline. This price quote assists make certain that a task can be finished within the allocated time and resources. Without it, a project may run out of funds prior to conclusion, triggering potential work blockages or abandonment.

What Does Pvm Accounting Mean?

Accurate work costing can help you do the following: Understand the profitability (or do not have thereof) of each task. As task costing breaks down each input into a job, you can track profitability separately.

By identifying these items while the project is being finished, you prevent shocks at the end of the project and can address (and hopefully avoid) them in future projects. An additional tool to assist track jobs is a work-in-progress (WIP) timetable. A WIP timetable can be finished monthly, quarterly, semi-annually, or annually, and includes task information such as contract worth, costs incurred to date, overall estimated costs, and complete job payments.

Our Pvm Accounting PDFs

Budgeting and Forecasting Devices Advanced software application supplies budgeting and projecting capabilities, permitting building companies to intend future tasks much more properly and manage their funds proactively. Paper Management Building and construction jobs involve a whole lot of paperwork.

Improved Vendor and Subcontractor Management The software application can track and manage settlements to vendors and subcontractors, making certain timely repayments and keeping great relationships. Tax Obligation Preparation and Filing Audit software application can assist in tax obligation prep work and declaring, making certain that all relevant monetary activities are accurately reported and taxes are filed on schedule.

Pvm Accounting Fundamentals Explained

Our client is a growing development and building company with head office in Denver, Colorado. With numerous energetic building jobs in Colorado, we are searching for an Accounting Aide to join our group. We are looking for a permanent Bookkeeping Assistant who will certainly be in charge of giving functional support to the Controller.

Receive and examine day-to-day billings, subcontracts, change orders, acquisition orders, inspect demands, and/or various other related documentation for completeness and compliance with monetary policies, procedures, budget plan, and legal needs. Update month-to-month evaluation and prepares spending plan fad reports for construction projects.

What Does Pvm Accounting Mean?

In this overview, we'll explore different aspects of building accountancy, its value, the standard devices used in this field, and its role in building jobs - https://www.tumblr.com/pvmaccount1ng/751115138904522752/pvm-accounting-is-a-full-service-construction?source=share. From monetary control and cost estimating to cash money circulation management, explore exactly how accountancy can profit building and construction tasks of all ranges. Building accounting refers to the specialized system and processes used to track financial details and make strategic choices for building and construction companies

Report this page